Investors long-term stock market investments ke faiday aur risks ko analyze karne ke liye am commonly fundamental, technical, aur quantitative analysis ka istemal karte hain. Fundamental, technical, aur quantitative analysis ke beech ke farq ko samajh kar, traders ko teen qeemti stock-picking strategies mil jati hain jo unhe munafa-dih investment decisions lene mein madadgar hoti hain.

Fundamental Analysis

Aksar investors jo long-term investment decisions lena chahte hain, woh aksar ek company, ek individual stock, ya poora market fundamental analysis se shuru karte hain. Fundamental analysis ek security ki asli qeemat ko nazar andaz karna hai, jisme business ya market ke har pehlu ko evaluate kiya jata hai. Company ke malik hone wale land, equipment, ya buildings ke sath-sath trademarks, patents, branding, ya intellectual property jaise intangible assets bhi tafseel se janch kiye jate hain.

Technical Analysis

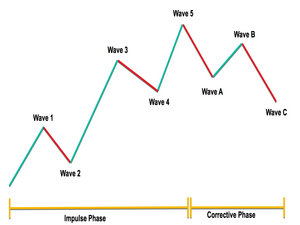

Securities ko statistics ke istemal se evaluate karne ka yeh process technical analysis kehlata hai. Analysts aur investors market activity ki data, jaise ke historical returns, stock prices, aur trading volume ka istemal karke securities ke movements ka pattern chart banate hain. Jabki fundamental analysis ek security ya specific market ki asli qeemat dikhane ki koshish karta hai, technical data future performance ka insight dena ka irada rakhta hai.

Technical analysis short periods ke data ka istemal karke securities ya market ke movements ko predict karne ke patterns develop karta hai, jabki fundamental analysis years tak ki information par bharosa karta hai. Technical analysis ke data collection ka short duration hone ke bawajood, investors ise zyada tar short-term trading mein istemal karte hain. Lekin jab ise fundamental analysis ke saath combine kiya jata hai, toh ye long-term investments ko evaluate karne mein bhi kaaragar sabit ho sakta hai.

Quantitative Analysis

Company ya broader market ki historical performance ko evaluate karne ke liye am often quantitative analysis ka istemal karte hain. Investors financial ratios jaise ke earnings per share (EPS) ya discounted cash flow (DCF) jaise simple ya complex calculations se quantitative analysis karte hain. Iske natije security ya market ki valuation ya historical performance ke baare mein insight deti hain.

Conclusions

Fundamental analysis zyadatar long-term investments ke quality ko determine karne mein istemal hoti hai, jabki technical analysis short-term investment decisions, jaise ke active stock trading ke liye zyadatar istemal hoti hai. Quantitative analysis company ki financial strength ko assess karne ke liye istemal hoti hai. Kuch investors long-term investments ko evaluate karne ke liye ek hi analysis method ka istemal karna pasand karte hain, lekin teeno types ka combination sabse faidemand sabit hota hai.

Fundamental Analysis

Aksar investors jo long-term investment decisions lena chahte hain, woh aksar ek company, ek individual stock, ya poora market fundamental analysis se shuru karte hain. Fundamental analysis ek security ki asli qeemat ko nazar andaz karna hai, jisme business ya market ke har pehlu ko evaluate kiya jata hai. Company ke malik hone wale land, equipment, ya buildings ke sath-sath trademarks, patents, branding, ya intellectual property jaise intangible assets bhi tafseel se janch kiye jate hain.

Technical Analysis

Securities ko statistics ke istemal se evaluate karne ka yeh process technical analysis kehlata hai. Analysts aur investors market activity ki data, jaise ke historical returns, stock prices, aur trading volume ka istemal karke securities ke movements ka pattern chart banate hain. Jabki fundamental analysis ek security ya specific market ki asli qeemat dikhane ki koshish karta hai, technical data future performance ka insight dena ka irada rakhta hai.

Technical analysis short periods ke data ka istemal karke securities ya market ke movements ko predict karne ke patterns develop karta hai, jabki fundamental analysis years tak ki information par bharosa karta hai. Technical analysis ke data collection ka short duration hone ke bawajood, investors ise zyada tar short-term trading mein istemal karte hain. Lekin jab ise fundamental analysis ke saath combine kiya jata hai, toh ye long-term investments ko evaluate karne mein bhi kaaragar sabit ho sakta hai.

Quantitative Analysis

Company ya broader market ki historical performance ko evaluate karne ke liye am often quantitative analysis ka istemal karte hain. Investors financial ratios jaise ke earnings per share (EPS) ya discounted cash flow (DCF) jaise simple ya complex calculations se quantitative analysis karte hain. Iske natije security ya market ki valuation ya historical performance ke baare mein insight deti hain.

Conclusions

Fundamental analysis zyadatar long-term investments ke quality ko determine karne mein istemal hoti hai, jabki technical analysis short-term investment decisions, jaise ke active stock trading ke liye zyadatar istemal hoti hai. Quantitative analysis company ki financial strength ko assess karne ke liye istemal hoti hai. Kuch investors long-term investments ko evaluate karne ke liye ek hi analysis method ka istemal karna pasand karte hain, lekin teeno types ka combination sabse faidemand sabit hota hai.

تبصرہ

Расширенный режим Обычный режим